According to the organization Internet site, the average borrower of an Avant own loan incorporates a credit history rating starting from 600 to seven hundred, which makes it a good alternative for individuals with reasonable credit rating.

Own loans serve various uses and include interesting capabilities like flexible phrases and reduced fascination prices. Our guideline outlines almost everything you have to know, which includes how they work and what skills you need to get a personal loan.

Any Fed cuts will probably Have a very direct impact on own loan fees. “Own loans are pegged to temporary curiosity charges such as the prime level that moves in live performance with Fed curiosity price cuts,” McBride clarifies.

A private Loan can help you mitigate losses and obtain again on the right track. Click here to check out your choices!

Mainly because Basel III regulations need financial institutions to fulfill bigger capital reserve and liquidity protection ratio necessities, they have to Restrict the loan belongings on their own harmony sheets relative to deposits and fairness funds. Thus, They can be unable to match private lenders.

The Bankrate guarantee Launched in 1976, Bankrate has a lengthy reputation of helping individuals make wise fiscal possibilities. We’ve managed this standing for more than 4 a long time by demystifying the fiscal determination-producing course of action and giving individuals self confidence in which actions to just take following. Bankrate follows a rigid editorial policy, to help you trust that we’re Placing your interests initial.

Enjoy our current webinar, where by our investment team talked about how key coverage variations could shape the outlook for financial growth and inflation.

U.S. Financial institution incorporates a starting off APR that competes with the top personal loan prices within the industry. The financial institution provides various loan forms, including private loans and residential enhancement loans, plus lines of credit history for various reasons.

And these supplemental prices are for only one yr of borrowing, Therefore the legitimate expense of the improved costs may be Considerably larger. Whilst student loan borrowers could possibly decrease monthly payments through earnings-driven repayment ideas, curiosity continues to accrue underneath most plans, and borrowers can be unaware of these repayment strategies

Observe our current webinar, where by our investment decision workforce talked about how critical coverage improvements could form the outlook for financial progress and inflation.

As such, we continue being devoted to helping clientele navigate pitfalls, capitalize on possibilities, and renovate operations as necessary. Be sure to get to out to debate how we could assistance you with transactions in 2024’s shifting loan landscape.

Bankrate Main financial analyst Take into consideration beefing up your crisis financial savings to avoid large-Value financial debt Later on.

You can get own loans from financial institutions, credit score unions, or from on the web and peer-to-peer lenders. It’s significant you only click here apply to trustworthy lenders because you’ll have to deliver your Individually identifiable info on your application, which includes your Social Safety selection and tackle.

Loan stakeholders have to stand able to adapt. Requirements and expectations for companies delivered by suppliers like agents and trustees will continue to alter in the course of 2024.

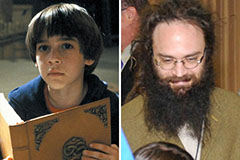

Barret Oliver Then & Now!

Barret Oliver Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!